Services

Welcome to a world of limitless possibilities, we are here to help and guide you. Be it Minor Goal Based Investing, Hassle-free NRI Investment route, Retirement Planning, Anyone/Survivor or Joint Holder Investing, Wealth Building, et.al.

Minor Investing

Yes, Minor investing sounds complicated, isn’t it? PAN Card, Bank Account, Aadhar Card, etc.

Worry not, Minor Investing is very simple and very rewarding to achieve all goals for your Child’s future.

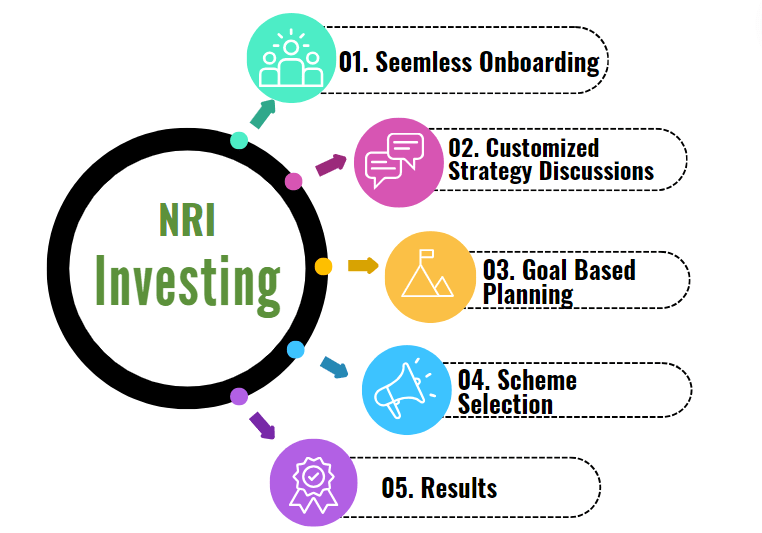

NRI (Non- Resident Indian) Investing

We have helped many Non-Resident Indian (NRIs) to seamlessly guide them to invest in India’s Growth Story.

Don’t worry about the DTAA (Double Taxation Avoidance Agreement), we are their to guide you to help you achieve your financial goals.

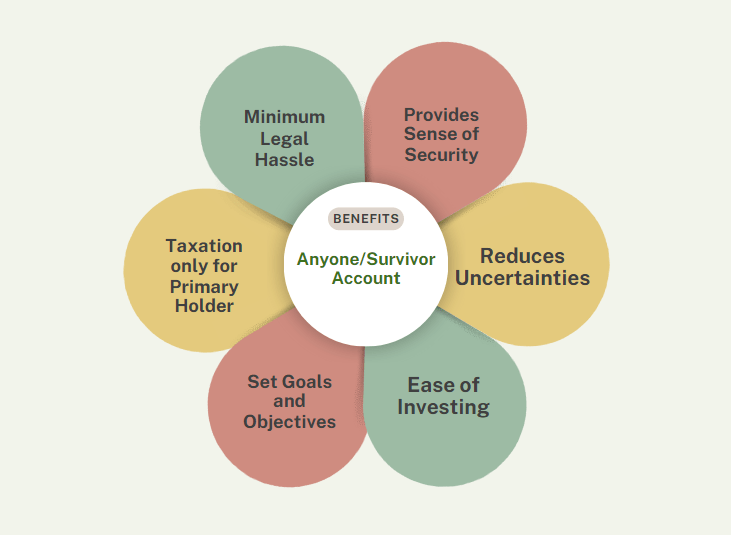

Anyone/Survivor Investing

Anyone/Survivor Investing is a great tool for couples who wishes invest which provides above listed benefits.

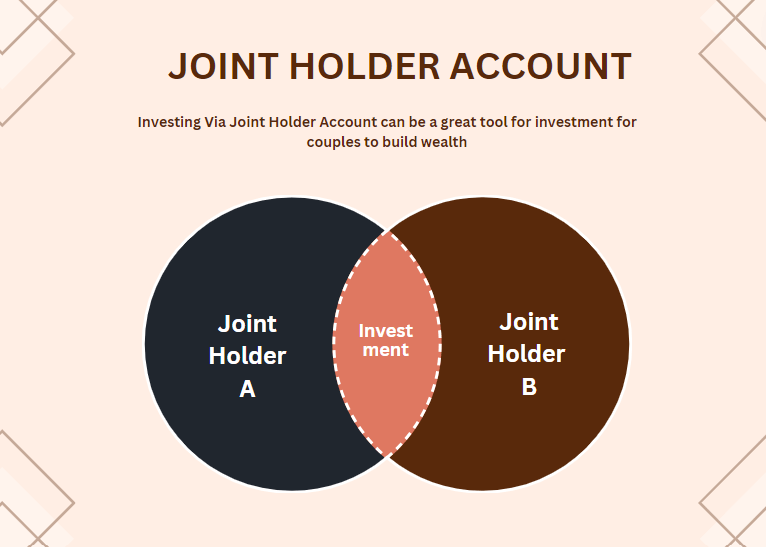

Joint Holder Investing

Joint Holder Investing is a great tool for couples who wishes invest together. Easy onboarding process but Joint Holder Investing comes with its pros and cons.

Connect with us to explore and consult if this is something which works as per your needs.

Retirement Planning

Navigating life’s after a certain age becomes easy if we plan for our retirement a tad too early. Who’s wouldn’t want a healthy corpus when nearing their retirement age or for ones who aspires to retirement early.

SIP and STP Structure & Strategy

Systematic Investment Plan or Strategic Transfer Plan are tools which helps investor with patience & persistence to build great wealth. Read our blog to understand how structure and strategy can increase your returns: https://investingtfd.com/2024/05/12/sip/