Image Courtesy Google: Sir Isaac Newton Art Work

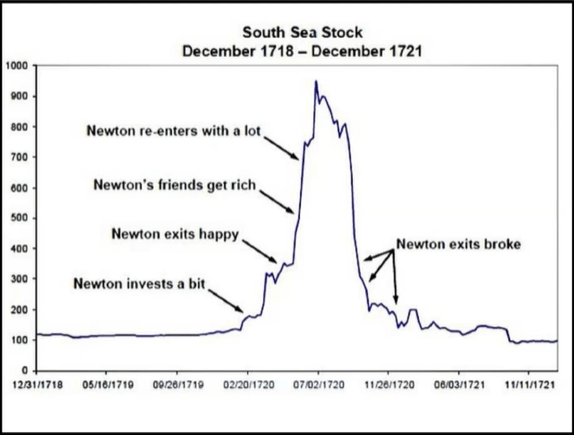

You guessed it correctly. Yes, Sir Isaac Newton, a man with an IQ of 190+, lost £20,000 while investing in South Sea Stock back in 1720 when his emotions got the better of him. £20,000 was a big big amount at that point of time.

Let’s work out a number in today’s world while being conversative in our approach. Assuming £20,000 is compounded annually with 2% interest and tenure is 304 years (2024–1720), this would amount to circa £8.2 million, or Rs. 87 crores (assuming an exchange rate of Rs. 106 per pound). It’s mind-blowing, isn’t it? Sir Isaac’s investment in the South Sea stock eventually drowned him.

Let’s examine the above chart. Initially, Sir Isaac had a diversified portfolio, with South Sea being one of the stocks. When the stock rose, Sir Isaac sold the stock and made a profit of £7,000. Not bad at all. Then his friend sold at a higher price, and Sir Isaac re-entered at an even higher price because of the FOMO (Fear of missing out) & stock market frenzy. Could it be that his emotions and greed got the better of him? It’s easier to conclude in hindsight, but don’t we experience this every now and then. Does GameStop ring a bell? Recent PSU/Defence rally? or the current notion that the market will never fall? Eventually, Sir Newton sold all the South Sea Stock while it took a fall and incurred a huge loss of £20,000.

If only one could predict the future. It’s not that Sir Isaac was a new and amateur investor, he had been investing in diverse stocks since the early 1700s, but this time he let go of the fundamental things, which are, Discipline, Patience & Persistence and incurred a loss. Which is why, if you have a long-term horizon then don’t let FOMO get better for you. Sometimes, POMO (Pleasure of missing out) works out just fine. We always believe there are no right or wrong when it comes to investing, only learnings. With the unlimited and unfathomable reach of Social Media, finance and investing can be overwhelming and confusing, we would suggest to seek out professional help to help you better manage your hard earned money as sometimes, we just need someone to hold our hands and make rational decisions on our behalf while guiding and educating us through our financial goals.

Don’t be like Sir Isaac Newton when it comes to investing. If one let FOMO overtake ones emotions, there is a good probability one might lose a fortune or not reach their goals on time. Follow our social media channels (linktr.ee/investingtfd) as we try to educate our audience, and connect with us if you need our help structuring your mutual fund portfolio basis your financial goals and risk appetite. Our team of professionals will guide you via our free consulting sessions.

We recently did a blog on how one can structure and strategies their SIPs; give it a read. Link below: (https://investingtfd.wordpress.com/2024/05/12/sip/).

Comment and let us know your thoughts about this blog. Till then, happy investing!!

Disclaimer: Please note that all the above views are personal and compiled through research and personal experiences. Though it may make sense and suit a few, to others it may not. Happy Investing.

Leave a comment