NSE Indices, a subsidiary of the National Stock Exchange, has just launched a new and first-of-its-kind EV and New age automotive (such as hybrid vehicles, hydrogen fuel-based vehicles, and green hybrid vehicles) index.

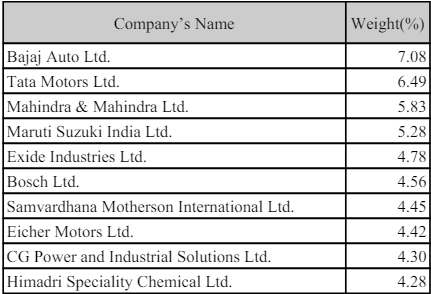

With such an innovative Index being launched, we might now see AMCs (Asset Management Companies) come up with new thematic funds or ETFs in the near future targeting investors who wish to participate in the EV revolution in the country. Currently, this Index is made up of 33 stocks and Index would be re-balanced semi-annually. The top 10 holdings per weight are as below with 70% of the index constitutes automobiles and auto components, while another 10% is allocated to the IT and chemical sectors. For the full list of 33 stocks, please click on ‘Index Statistics‘ under Downloads in this link: https://www.niftyindices.com/indices/equity/thematic-indices/nifty-ev-new-age-automotive

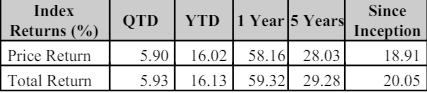

The index has a base date of April 2, 2018, which would mean, as per the below graph, that it’s 1-year return would have been 59.32% and 29.28 as a 5-year return. Not bad at all. Should new funds/ETFs starts to come into market, should you jump on the gravy train? That is purely how one sees the potential of EVs and hybrids in the years to come. One thing is for sure: there are going to be massive changes in the automotive sector, and this index has been designed keeping that in mind to cater to the needs of investors and provide a more suitable benchmark.

This is one to keep an eye on. I believe something like this should form part of your satellite portfolio (tactical) but not your core portfolio (strategic). Please talk to your financial advisor or connect with us for a free consultation (we follow a no-spam policy), who can assist you in understanding your needs as per your financial goals, as thematic funds fall into the high-risk category and may not be suitable for everyone.

One can read more about this index in detail at the above link shared. If you need any help or are in a dilemma, just drop us a Direct Message on any of our social media accounts or comment down below, and we will get in touch with you to assist in defining your SIP structure via our free consulting sessions.

Disclaimer: Please note that all the above views are personal and compiled through research and personal experiences. Though it may make sense and suit a few, to others it may not. Happy Investing.

Leave a comment