Image taken from Google: Quinten Massys, Tax Collectors, late 1520s

Corporate NPS, Section 80 CCD(2): We will not call it an unrated route to save tax, but something that not a lot of employees are aware of or have not yet availed of.

An analysis of how to reap benefits under both the new and old regimes while saving some tax. Also, we will also find out if is this something really for you?

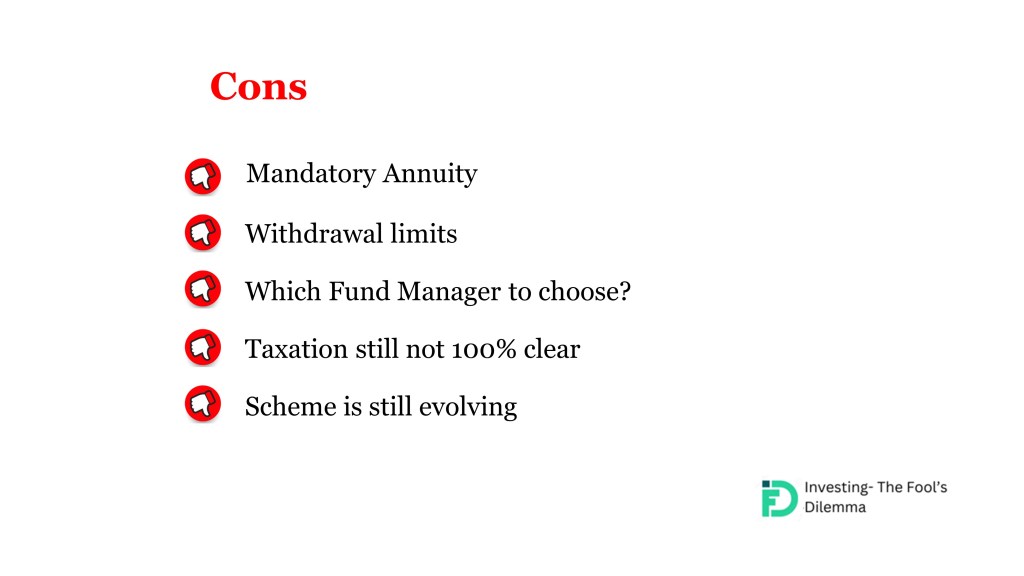

Let’s start with why is this not a great tool for saving taxes, investing, and retirement planning? (Bit unusual isn’t it? as normally blogs and articles talks about the positive first)

👎 Mandatory Annuity: At the time of maturity (which is after retirement), one can withdraw 60% of the funds, and the remaining are used to buy an annuity. The returns of annuities are not tax-exempt.

👎Withdrawal Limits: Subscribers are not allowed to withdraw before attaining the age of 60, as they are made by your employer on your behalf.

👎Which Fund Manager to choose? There are many fund managers to choose from, but which one yields the best returns? Periodic review might be required. We will do a separate series where we will show how to change Fund Manager if others are performing better.

👎 Taxation at the time of withdrawal: NPS is an evolving product; hence we can see few changes in the taxation at the time of withdrawal in the coming times which should favor the investor

👎Scheme is still evolving: PFRDA and government are adding a lot of features to make it more attractive since it’s inception. We might see a few more in the coming years.

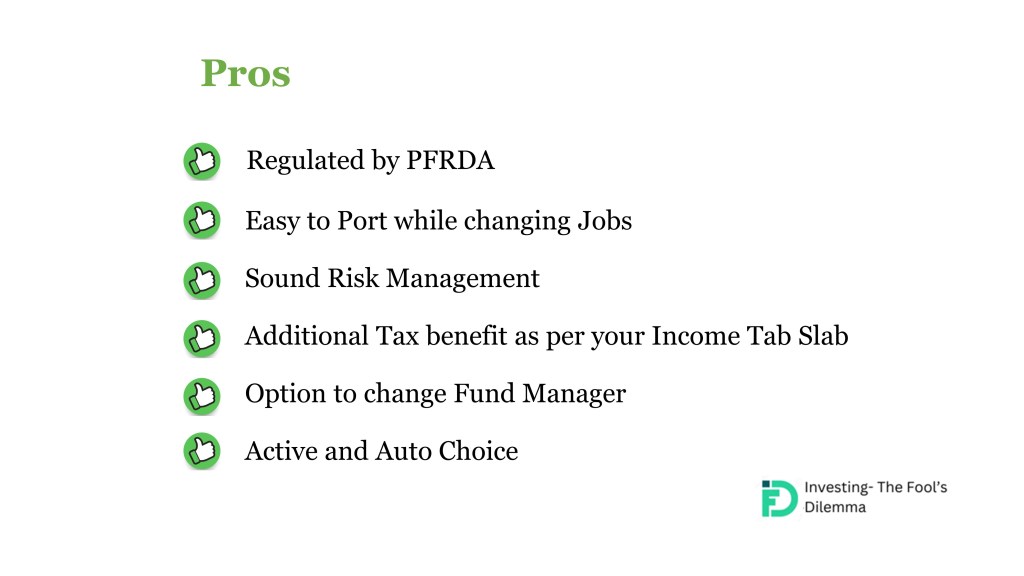

Let’s look at why Corporate NPS shouldn’t be overlooked and make a great addition to your portfolio of long-term investments.

👍 Regulated: It is regulated by PFRDA which is always a plus in times where a lot of unregulated products are floating in the market.

👍Portability: One can use their existing PRAN number to link their Corporate NPS. There is no need for a separate account/PRAN to be produced. Moreover, it is easy to port while changing jobs as well. One just needs to mention the PRAN and voila, it’s done.

👍Sound Risk Management: One can start with higher allocation to the equity class but the equity exposure is reduced gradually every year by 2.5% starting from the year in which the investor turns 50 years of age. This helps stabilize the risk-return exposure of the investor.

👍 👍 Additional Tax Benefit under both New and Old Tax Regimes: We have given this 2 thumbs up. Consider saving tax up to 14% of your basic + DA up to 7.5 lacs (including your employer’s contribution to EPF and Superannuation). As an example, if you have a basic salary of 5,00,000 per annum, then 50,000 if deducted under Corporate NPS can be tax free (as per your income tax slab).

Employee at higher tax bracket can benefit a ton from it & earn returns which are second to none if compared to Mutual Funds.

👍 Option to change your Fund Manager: NPS allows one to change their Fund Manager if they are under-performing compared to their peers. We will do a series very soon highlighting how that can be done.

👍 Active and Auto Choice: While opening the account, one has an option to choose from active (one can allocate exposure to Equity, Government Securities and Corporate Bonds as per their own) or auto choice (which is based on the age of the investor and discretion of the fund manager)

We helped couple of clients to reach out to their HRs and avail the benefits of Corporate NPS.

If you need any help or are in a dilemma, just drop us a Direct Message on any of our social media accounts or comment down below, and we will get in touch with you to assist with any queries on Corporate NPS via our free consulting sessions.

Disclaimer: Please note that all the above views are personal and compiled through research and personal experiences. Though it may make sense and suit a few, others may not find it beneficial. If you notice artwork at the start of my blogs, it is only because I love art. Happy Investing.

Leave a comment